In an era where technology permeates nearly every aspect of our lives, the way we conduct financial transactions has undergone a significant transformation. The traditional manual mode of payment, once the backbone of commerce, is rapidly giving way to automated systems. This shift not only streamlines processes but also enhances security, efficiency, and user experience. As businesses and consumers alike navigate this evolving landscape, understanding the benefits and implications of automated payment modes becomes crucial.

The Evolution of Payment Modes

Historically, payments were predominantly made through physical cash exchanges, checks, and manual processing of credit card transactions. These methods, while familiar and straightforward, were often fraught with inefficiencies and security vulnerabilities. Long lines at bank counters, delayed check clearances, and the risk of human error were common challenges associated with the manual mode of payment.

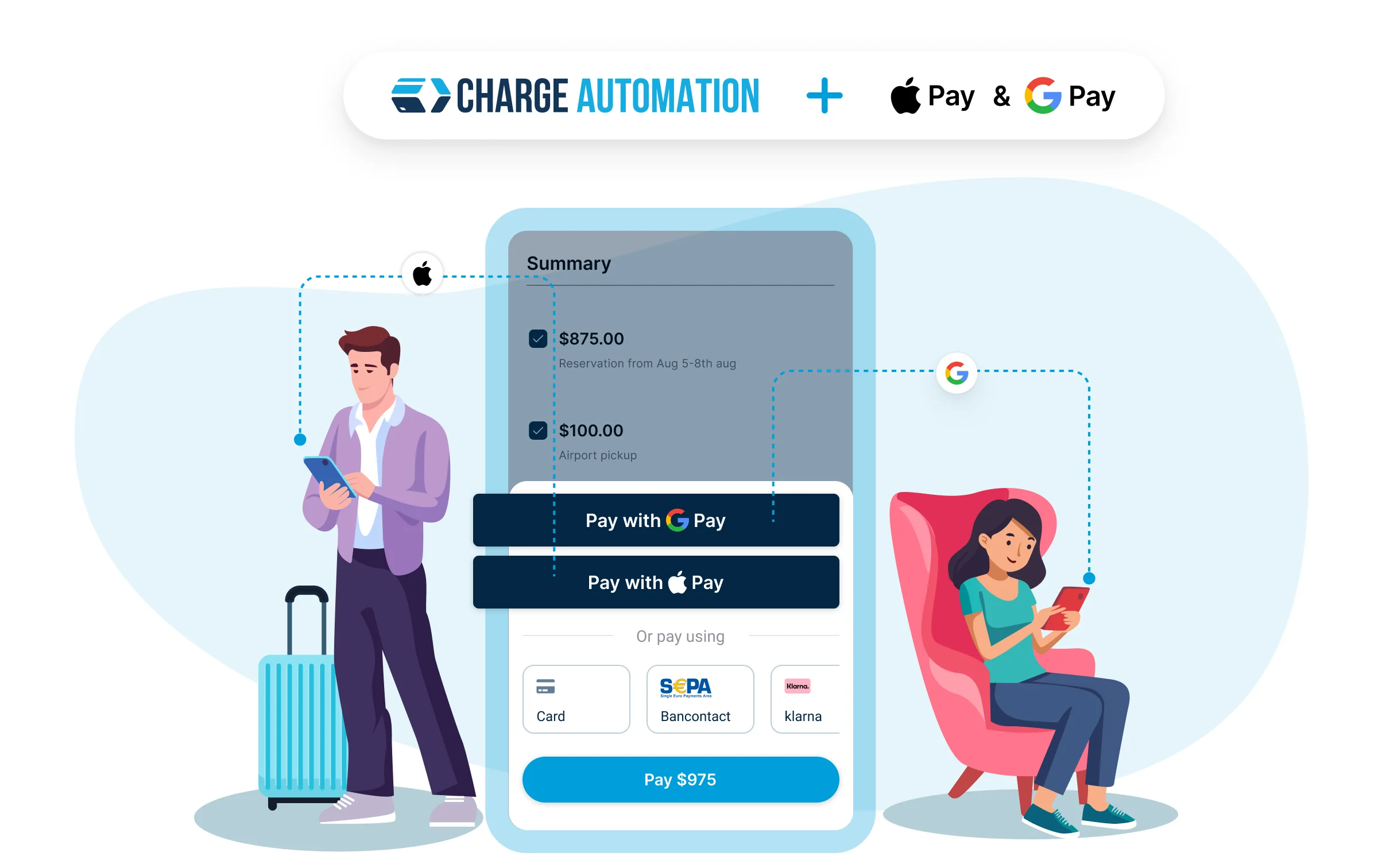

The advent of digital technology initiated a paradigm shift. Electronic payments, starting with credit and debit card transactions and evolving into online banking, mobile payments, and cryptocurrency, began to gain traction. These innovations laid the groundwork for a more efficient and secure mode of payment that caters to the demands of the digital age.

Advantages of Automated Payment Modes

Automated payment systems offer numerous benefits that address the limitations of manual methods. From enhanced efficiency and security to improved cost-effectiveness and convenience, these systems revolutionize the way transactions are conducted. Delving into these advantages highlights why automation is becoming the preferred choice for businesses and consumers alike. Here’s a table summarizing the advantages of automated payment modes:

| Advantage | Description |

|---|---|

| Efficiency and Speed | Automated payment systems significantly reduce the time required to process transactions, enhancing the customer experience and improving cash flow for businesses. |

| Enhanced Security | Advanced encryption, tokenization, multi-factor authentication, and biometric verification techniques safeguard sensitive information, reducing fraud and unauthorized access. |

| Cost-Effectiveness | Initial investment in automated payment systems leads to long-term savings through reduced manual labor, minimized errors, and faster transaction processing, lowering operational costs. |

| Convenience and Accessibility | Consumers can make payments anytime, anywhere, using various devices, offering unparalleled convenience, especially in today’s fast-paced world. |

| Real-Time Tracking and Reporting | Automated systems provide real-time tracking and reporting capabilities, enabling businesses to monitor transactions, analyze spending patterns, and generate financial reports easily, facilitating better decision-making and financial planning. |

Challenges in Transitioning to Automated Payment Modes

Despite the clear benefits, shifting from manual to automated payment systems presents several challenges. Businesses must overcome hurdles related to setup, security, user adoption, and regulatory compliance. Exploring these challenges is essential for understanding the complexities involved in this transition and finding effective solutions. Businesses must navigate several hurdles to ensure a smooth and successful shift.

- Initial Setup and Integration – Implementing automated payment systems requires significant upfront investment in technology and infrastructure. Additionally, integrating these systems with existing platforms and processes can be complex and time-consuming.

- Security Concerns – While automated systems are generally more secure, they are not immune to cyber threats. Ensuring robust cybersecurity measures and staying ahead of emerging threats is crucial to protecting sensitive financial data.

- User Adoption and Education – For consumers accustomed to manual payment methods, transitioning to automated systems can be daunting. Businesses must invest in educating their customers and providing support to facilitate this change.

- Regulatory Compliance – Navigating the regulatory landscape is another challenge. Businesses must ensure that their automated payment systems comply with relevant laws and regulations, which can vary by region and industry.

Future Trends in Payment Automation

The landscape of payment automation is continually evolving, driven by advancements in technology. Emerging trends such as artificial intelligence, blockchain, the Internet of Things (IoT), and biometric payments are poised to further transform the industry. Examining these trends offers a glimpse into the future of payment systems and their potential impact on commerce.

- Artificial Intelligence and Machine Learning – AI and machine learning are set to revolutionize payment automation. These technologies can analyze vast amounts of data to detect fraud, personalize user experiences, and optimize transaction processes.

- Blockchain and Cryptocurrency – Blockchain technology offers a decentralized, transparent, and secure mode of payment. Cryptocurrencies, although still in their nascent stages, have the potential to disrupt traditional financial systems by offering an alternative to conventional currency transactions.

- Internet of Things (IoT) – IoT devices are increasingly being integrated with payment systems. From smart refrigerators that reorder groceries to connected cars that pay for fuel, IoT is paving the way for seamless and automated payment experiences.

- Biometric Payments – Biometric authentication, such as fingerprint and facial recognition, is becoming more prevalent in payment systems. This technology not only enhances security but also simplifies the payment process, making it more user-friendly.

Conclusion

The transition from manual to automated payment systems marks a significant milestone in the evolution of commerce. As businesses and consumers embrace these advanced modes of payment, the benefits in terms of efficiency, security, and convenience are undeniable. However, navigating this transition requires careful planning, investment, and a proactive approach to addressing challenges. By staying informed about emerging trends and adopting best practices, businesses can optimize their payment systems for the digital age, ensuring a seamless and secure transaction experience for all stakeholders.